Market Trends: What's New About Buying a Used Car?

Choosing to buy a new or used car used to be straightforward. That’s changed a bit, thanks to the pandemic, particularly because of the car chip shortage. While new cars are becoming more plentiful, rising interest rates and general inflation may have you considering options you never would have before, like buying out a lease or buying from a private seller—or becoming a private seller. Also, if you need to buy a car, it might be trickier to find what you want, no matter the price range. Here’s what to know.

If You Lease, Your Car May Have More Value Now Than it Did Two Years Ago

You may have the option to buy out your lease at a lower cost than the value of the car. That’s a rare situation, and it provides some unique options. For example, you could buy out the lease and then sell it privately, giving you extra cash to put toward a down payment on a different ride. Or you could buy your leased car and keep it, with equity. Talk to the dealership you leased it from to learn more.

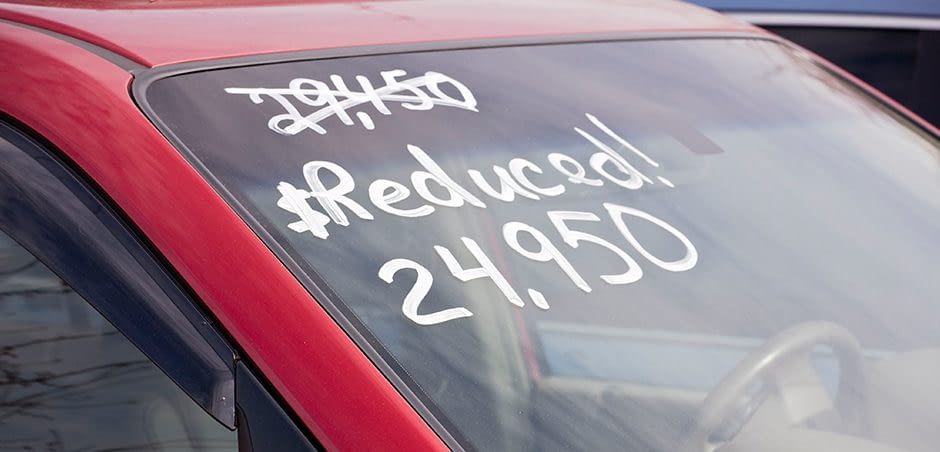

New Cars Are Hard to Come By, and Deals on Used Cars May Be Hard To Find

Factory lead time on new cars can be up to three months, so give yourself time if you plan to customize a new car. Because of long wait times, more people than ever are buying used, making the market more competitive and used car prices higher than normal. It’s best to do some research online and on the lots in your local area to know your choices. You might also consider buying privately, after you’ve thoroughly reviewed the market. If you buy privately, make sure to do a background check on the vehicle using CARFAX or a similar service.

Your Checklist for Buying New or Used

Step 1: Get Your Finances in Order

- Decide if you want a monthly payment. And if so, how much do you want to pay each month. Knowing this number will help you make decisions about whether to buy or lease and how to set your price range.

- Get pre-approved for an auto loan. Unless you are leasing or paying cash out of your savings, you’ll need an auto loan. Most dealerships offer financial assistance (or they’ll help you shop around for an auto loan), but you’ll be in a better position to negotiate if you have this step checked off before you enter the lot. Also, if you decide to buy a car from a private party, your finances will be all set.

- Shop for the best interest rate. Lenders consider different factors when underwriting auto loans, so it’s a good idea to shop around for at least four or five options.

Step 2: Make Your Wish List

You may dream of that sporty two-seater, but will it really work for your lifestyle? Ask these questions to help guide your search:

- What’s more important: space, comfort or sport utility?

- How many seats do you need? Is it just you and one or two passengers? Or a whole crew? (Choosing between an SUV and a minivan alone can be quite a decision.)

- How many miles do you plan on driving per year?

- Do you haul anything, like a boat or camper? If so, how much weight do you often tow?

- Do you need all-wheel drive for snowy or icy weather, or does two-wheel drive provide what you need?

- How much are you willing to spend on gas? And what are your expectations for fuel efficiency?

- If you’re considering an electric or hybrid model, do you have a way to charge an electric car, or are there charging stations nearby?

Step 3: Do Your Research

- Look at dealership websites in your area to find out what inventory is already available nearby.

- Review Kelley Blue Book values and CARFAX reports.

- If you’re considering buying a car online, read this article on the ins and outs of internet car shopping.

- Chat with us to give you an idea of which cars will cost more or less to insure, so you can budget for your new ride.

Step 4: Start Wheeling and Dealing

- Reach out to private sellers you’ve connected with online or know through family and friends.

- Talk to a dealership. Even if you don’t think you’ll buy from a dealership, you’ll learn a lot from the conversation, and you’ll have more opportunities to negotiate your options.

- Test-drive the rides that look most interesting. Try out at least three or four.

- Before making an offer, bump your test-drive experiences up against your wish list and your budget to make sure you’ve considered the purchase from several angles.

Last Step

Once you’ve made the switch to a new ride, make sure to contact us.

A better insurance experience starts with ERIE.

Haven’t heard of us? Erie Insurance started with humble beginnings in 1925 with a mission to emphasize customer service above all else. Though we’ve grown to reach the Fortune 500 list, we still haven’t lost the human touch.

Contact Associated Insurers, Inc. today to experience the ERIE difference for yourself.